Results 1 to 13 of 13

Hybrid View

-

18th Mar 2018, 04:06 PM #1

The United States and the European Union are two of the largest economic entities in the world. The U.S. dollar is the world's most heavily traded and most widely held currency and was on one side of 87.6% of all trades as of April 2016. The currency of the European Union, known as the euro, is the world's second most popular currency. In 2016, the Euro was on one side of 31.3% of the trades. Naturally, because EUR/USD is made up of the two most popular currencies in the world, it is the most actively traded currency pair in the forex market.

The United States Economy

According to the World Bank, as of 2016, The United States was the largest national economy in the world, with a gross domestic product (GDP) of nearly $19 trillion. The U.S. economy is largely service-based, although according to the Bureau of Economic Analysis, manufacturing still makes up approximately 12% of GDP. When economic activity in the United States is strong, the dollar generally strengthens; when economic activity slows, the dollar usually weakens. Because the United States is also considered a safe haven, the dollar tends to rise during times of global financial or political turmoil. U.S. policymakers have historically favored a strong dollar, and the U.S. Treasury sometimes intervenes in the currency markets if the dollar is perceived as too weak. (Also, see: The Fundamentals Of Forex Fundamentals and The 5 Industries Driving the U.S Economy)

The Unique Role of the U.S. Dollar

The U.S. dollar plays a unique role in the world of international finance. As the world's reserve currency, the U.S. dollar is used to settle most international transactions. When global central banks hold foreign currency reserves, a large portion of those reserves is often held in U.S. dollars. In addition, many smaller countries choose either to peg their currency's value to that of the U.S. dollar or forgo having their own currency, choosing to use the U.S. dollar instead. The price of gold (and other commodities) is generally set in U.S. dollars, too. Not only this, but the Organization of Petroleum Exporting Countries (OPEC) transacts in U.S. dollars. This means that when a nation buys or sells oil, it buys or sells the U.S. dollar at the same time. All of these factors contribute to the dollar's status as the world's most important currency.

Not surprisingly, the U.S. dollar is the most heavily traded currency. Most foreign currencies trade against the U.S. dollar more often than in a pair with any other currency. For this reason, it is important for investors interested in the currency markets to have a firm grasp of the fundamentals of the United States economy and a solid understanding of the direction in which the U.S. dollar is going. (To learn how to profit from a falling dollar, see Taking Advantage Of A Weak U.S. Dollar.)

The European Union Economy

As of 2016, the European Union represented one of the world's largest economic region with a GDP of $11.9 trillion. Like the United States, the economy of Europe is heavily focused on services, although manufacturing represents a greater percentage of GDP than it does in the United States. When economic activity in the European Union is strong, the euro generally strengthens; when economic activity slows, the euro usually weakens. The euro is used by nearly 340 million people every day. (For related reading, see: 5 Economic Reports That Affect The Euro)

Why the Euro Is Unique

While the U.S. dollar is the currency of a single country, the euro is the single currency of 16 European countries within the European Union, collectively known as the "eurozone" or the European and Economic Monetary Union (EMU). Disagreements sometimes arise among European governments about the future course of the European Union or monetary policy. When these political or economic disagreements arise, the euro typically weakens. (To learn more about why the euro is so important, see Top 8 Most Tradable Currencies.)

Which Countries use the Euro?

The euro is the official currency of 19 out of 28 members of the European Union. These countries are collectively referred to by many as the euro area. The countries that use the euro as the official currency include:

- Austria

- Latvia

- Belgium

- Lithuania

- Cyprus

- Luxembourg

- Estonia

- Malta

- Finland

- the Netherlands

- France

- Portugal

- Germany

- Slovakia

- Greece

- Slovenia

- Ireland

- Spain

- Italy

Factors Influencing the Direction of the EUR/USD

The primary factor that influences the direction of the EUR/USD pair is the relative strength of the two economies. With all other things being equal, a faster-growing U.S. economy strengthens the dollar against the euro, and a faster-growing European Union economy strengthens the euro against the dollar. One key sign of the relative strength of the two economies is the level of interest rates. When U.S. interest rates are higher than those of key European economies, the dollar generally strengthens. When eurozone interest rates are higher, the dollar usually weakens.

Another factor that can have a strong influence on the EUR/USD relationship is political instability among the members of the European Union. The euro currency is unique in that it is a common currency for 19 European nations. As the countries within the eurozone learn to work with each other, differences sometimes arise. For example, results from the UK Referendum in 2016 to leave the European Economic Union and major elections in countries such as Germany, France, Greece, Italy, and Spain all have an impact on the direction of currencies. Other major events such as Switzerland’s decoupling from the euro peg also causes major changes to exchange rates. If these differences appear serious or potentially threatening to the future stability of the eurozone, the dollar is likely to strengthen against the euro. (For more, see: Healthiest And Safest European Economies)

Trading the EUR/USD

Because the EUR/USD represents currencies from the world's two largest currencies from the world's two of the largest economic and trading blocs, multinational corporations typically conduct business in both the United States and Europe. These corporations have an almost constant need to hedge their exposure to the risk of currency movement. Some firms, such as international financial institutions, have offices in both the United States and Europe. These firms are also constantly involved in trading the EUR/USD. In 2016, the USD/EUR pair represented 23% of daily turnover. (For more, see: What is hedging as it relates to forex trading?)

Because the EUR/USD is such a popular currency pair, arbitrage opportunities are not often available. However, investors still enjoy trading the pair. As the world's most liquid currency pair, the EUR/USD offers very low bid-ask spreads and constant liquidity for traders wanting to buy or sell. These two features are important to speculators and help contribute to the pair's popularity. Furthermore, the large number of market participants and the availability of economic and financial data allow traders to constantly formulate and reassess their positions and opinions. This constant activity provides for relatively high levels of volatility, which can lead to opportunities for profit.

The combination of liquidity and volatility makes the euro/U.S. dollar pair an excellent place to begin trading for newcomers to the currency market. However, it is always necessary to understand the role of risk management when trading currencies or any other kind of instruments. (For more information, see Forex: Money Management Matters.)

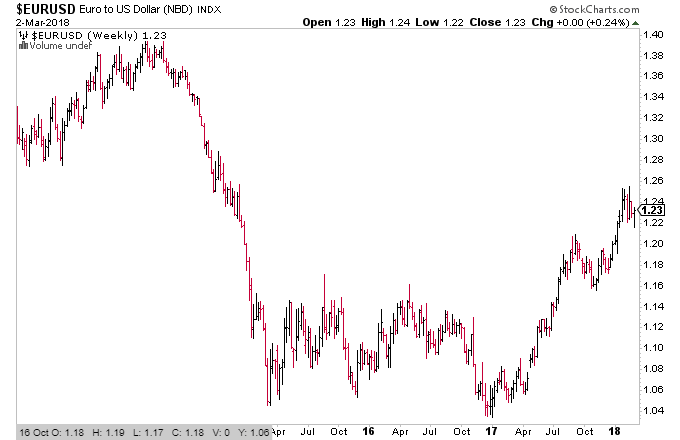

From a technical analysis perspective, by taking a look at the five-year weekly chart of the EUR/USD shown below, you can see that the Euro weakened relative to the U.S. dollar for much of 2014. The period of consolidation between 2015 and 2017 provided a technical base for the pair and was the zone that was needed for traders to have the confidence to push the rate higher again. (For more on this topic, see: Currency Charts To Watch)

EasyMoney Reviewed by EasyMoney on . Popular Forex Currencies https://i.investopedia.com/inv/topics/images/active-trading-lrg.jpg The currency markets are the largest and most actively traded financial markets in the world with a daily trading volume of more than $5.1 trillion (Triennial Central Bank Survey 2016). The majority of this trading is concentrated in the world's major financial centers such as London, New York and Tokyo. Large institutional investors such as banks, multinational corporations, hedge funds and central banks constitute Rating: 5

-

12th May 2019, 06:11 PM #2

Popular Forex Currencies

Popular Forex Currencies

guysIm happy to give you my signals for currencies. Each week I will write a swing signal if there was a good signal and daily I will put a signal with 100 pips target 70 pips stop loss. All the signals will be with the chart and reasons . I hope all of signals would be green.Wait me after some hours. Regards,Abanoub

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Similar Threads

-

[GET] Learn to Trade Forex and Stocks: From Beginner to Advanced

By AliKashif7 in forum Udemy 100% FREE for LIMITED TIMEReplies: 2Last Post: 13th May 2019, 02:57 PM -

Mining of crypto-currencies on P2pool

By kryptonite in forum Mining and PoolsReplies: 0Last Post: 13th Jan 2016, 02:42 PM

Reply With Quote

Reply With Quote

Staff Online

Staff Online

Shopsocks5.com - Check Socks5...

[Free Trial] https://shopsocks5.com/ - Service...