Results 1 to 13 of 13

-

18th Mar 2018, 04:04 PM #1

Popular Forex Currencies

Popular Forex Currencies

The currency markets are the largest and most actively traded financial markets in the world with a daily trading volume of more than $5.1 trillion (Triennial Central Bank Survey 2016). The majority of this trading is concentrated in the world's major financial centers such as London, New York and Tokyo. Large institutional investors such as banks, multinational corporations, hedge funds and central banks constitute the majority of the market activity. To knowledgeably compete in this overwhelmingly institutional marketplace, individual investors need to assimilate as much information as possible. This tutorial provides an overview of basic foreign currency (forex/FX) trading strategies, the markets for those strategies, and an examination of some of the most popular currencies traded.

How do currency transactions work?

Each transaction in the currency market involves two different trades: the sale of one currency and the purchase of another. The two currencies involved in the trade are known as a pair. While it is possible to swap virtually any currency for another, the majority of trading occurs among a handful of popular currency pairs. (For more on this topic, check out Reading a Forex Quote)

Currency

Market Share USD 87.6% EUR 31.3% JPY 21.6.3% GBP 12.8% AUD 6.9% CAD 5.1% CHF 4.8% CNY 4% SEK 2.2% MXN 2.2% NZD 2.1% SGD 1.8% HKD 1.7% NOK

1.7% KRW 1.6% Emerging Market Currencies 21.2%

The chart shows the most heavily traded currencies and their market share. Total market share adds up to 200% because each transaction involves two currencies (ECB: BIS Triennial Survey 2016).Figure 1: The most heavily traded currencies and their market share Source: BIS Triennial Survey, 2016

USD

As the world's reserve currency, the U.S. dollar is the most actively traded currency, and pairs involving the dollar make up the majority of transactions. In fact, the U.S. dollar was on one side of 88% of all trades in April 2016, up slightly from 87% in April 2013. Therefore, this tutorial examines the trading relationships between the U.S. dollar and several of its chief counterparts, including the euro, the Japanese yen, the British pound, and the Swiss franc. The tutorial also examines other popular trading pairs involving the U.S. dollar and the commodity currencies – those of Canada, Australia, and New Zealand.

Although the average trader will likely participate only in trades involving the U.S. dollar, this tutorial includes a discussion of cross rate pairs – pairs of significant international currencies that are not the U.S. dollar. Additionally, because emerging markets form an important part of the global financial system, this tutorial also examines the unique challenges facing individuals interested in trading emerging market currencies.(For more information, read The Foreign Exchange Interbank Market.)

Before the discussion of popular trading pairs, a brief analysis describes some of the instruments, concepts and strategies that should be familiar to investors trading in the currency markets. (For a quick refresher, check out: Forex Market Basics)

EasyMoney Reviewed by EasyMoney on . Popular Forex Currencies https://i.investopedia.com/inv/topics/images/active-trading-lrg.jpg The currency markets are the largest and most actively traded financial markets in the world with a daily trading volume of more than $5.1 trillion (Triennial Central Bank Survey 2016). The majority of this trading is concentrated in the world's major financial centers such as London, New York and Tokyo. Large institutional investors such as banks, multinational corporations, hedge funds and central banks constitute Rating: 5

-

18th Mar 2018, 04:05 PM #2

For beginning investors, there are a variety of currency trading strategies available. However, most strategies fall into two broad categories: hedging and speculating.

Using Forex to hedge your portfolio

When companies sell goods or services in foreign countries, they are usually paid in the currency of the country in which the sale occurs. But currencies can fluctuate, causing the sale to be valued (in the home country) at less than hoped for or expected. To avoid possible loss from fluctuating currencies, companies can hedge, or protect themselves, by trading currency pairs. Protection against the possibility of adverse currency movement helps companies focus on generating revenues.

Sometimes, traders in the international financial market hedge their foreign currency exposures to gain as much as possible from their investments. A mutual fund manager who wants to hold Japanese stocks, for example, may not want to be exposed to movements in the Japanese yen. As the manager hedges against those movements, she secures "pure" exposure to Japanese stock price movements – exposure unhampered by fluctuations. These hedging activities constitute a sizable portion of daily currency turnover. As such, they are important for investors to understand. (To learn more, read A Beginner's Guide To Hedging and Using Interest Rate Parity To Trade Forex.)

Speculating on moves in foreign exchange

The activities of most investors will fall under the broad category of speculation, which involves buying or selling a financial asset, usually in the face of higher-than-ordinary risk, in order to take advantage of an expected move. Speculators in the currency market wager that, in the future, the value of a currency will move higher or lower relative to another currency. In addition to individual investors, speculators in the currency market can include hedge funds, commercial banks, pension funds or investment banks. Currencies are traded in pairs, so in any given transaction, a trader is wagering that one currency will rise while the value of the second will fall. Most currency trading occurs among a handful of very liquid and active pairs. Investors interested in trading these pairs need to formulate an understanding of the characteristics of the currencies involved and the factors that cause the movements between the currencies that constitute these pairs. Popular pairs will be covered in much greater detail later in this tutorial. (For more insight, check out Using Currency Correlations To Your Advantage and Finding Profit In Pairs.)

Other Forex Trading Strategies

In addition to trades that focus upon the relative value between two currencies, there are also other popular types of currency trades. In arbitrage trades, an investor simultaneously buys and sells the same security (perhaps a currency) at slightly different prices, hoping to make a small, risk-free profit. While this is obviously an attractive proposition, arbitrage opportunities are very rare in efficient markets because there are many other investors also seeking to exploit these opportunities. Therefore, any arbitrage possibilities that do exist disappear quickly. Investors interested in arbitrage opportunities need to closely monitor market developments and act immediately when opportunities appear. When opportunities are available, the price differential is usually quite small. To generate a substantial profit, investors need to trade in sizes large enough to magnify the small price differentials. (To learn more about this strategy, read Trading The Odds With Arbitrage and Arbitrage Squeezes Profit From Market Inefficiency.)

Another popular category of currency trade is the carry trade, which involves selling the currency of a country with very low interest rates and investing the proceeds in the currency of a country with high interest rates. In this category, the trader generates a profit as long as the relationship between the two currencies is relatively stable. The carry trade is usually practiced by large, sophisticated investors (such as hedge funds) and is extremely popular during times of low market volatility. During high volatility, large fluctuations in the value of currencies and other financial assets can quickly overwhelm the traditionally slow-and-steady profits found in the carry trade. Therefore, investors tend to shun the carry trade when market volatility rises. (Learn more about this trade in Currency Carry Trades Deliver and Profiting From Carry Trade Candidates.)

-

18th Mar 2018, 04:05 PM #3

Trading Forex

The majority of currency trading takes place in the forex spot market. In the forex spot market, large banks and other financial institutions trade currencies among themselves either for immediate delivery (spot market) or for settlement at a later date (forward market.) Trades in the forex market occur over the counter, and the minimum size of trades is generally very large. For these reasons, it has traditionally been impractical for individual investors to trade in the forex market.

However, over the past several years, a new retail forex market has developed. This market allows individual investors and small institutions to trade in the forex market in smaller volumes than those previously available. For the more heavily traded currencies, bid-ask spreads are relatively narrow, and market liquidity can be excellent. Many currency brokerage firms will also allow investors high levels of leverage – in most cases 50:1. In the case of some brokers from outside the United States, leverage levels can be even higher. While the use of leverage can magnify investors' potential returns, it is important to remember that leverage also magnifies potential losses. Investors should carefully consider their risk tolerance before employing leverage. (For more information concerning leverage in the forex markets, see Forex Leverage: A Double-Edged Sword. For another viewpoint on leverage, also see Leverage's "Double-Edged Sword" Need Not Cut Deep.)

Because currency brokerage firms vary greatly in their resources, minimum account sizes, available leverage and execution ability, investors should carefully evaluate several brokerage firms before opening a currency trading account. (To learn more, see Forex Basics: Setting Up An Account.)

Derivatives Markets

Derivatives include futures, options and exotic, customizable derivative contracts. While the more exotic derivatives are generally designed for institutional investors, individual investors often use futures and options.

The most popular currency pairs have both futures contracts (that track the currency pair's movements) and options on those futures contracts. Individual investors can buy or sell the futures or the options to speculate on the direction of the currency pair. These futures and options usually feature reasonably good liquidity, transparent pricing and moderate capital requirements. For these reasons, futures or options are a viable choice for individual investors interested in the currency market. (Learn more about this method of forex trading in Getting Started In Foreign Exchange Futures.)

When using futures or options, it is very important to remain aware of the risks involved in using these financial instruments. While large gains are possible, the majority of investors using these securities eventually lose money. Additionally, futures contracts carry the possibility of potentially unlimited losses. Before employing a futures trading strategy, investors should carefully consider their risk tolerance and thoroughly understand potentially adverse price movements.(For more, see: How To Use FX Options In FX Trading)

Currency Exposure Using Exchange Traded Products

A relatively new addition to the currency trading universe is the exchange-traded fund (ETF). ETFs have been popular vehicles for tracking stock or bond indexes for many years, but ETFs that track currency movements are relatively new. A currency ETF can be bought and sold just like any other stock. Investors who believe the currency is about to rise in price should buy the ETF; investors who believe the currency will decline in value should sell the ETF. One advantage of ETFs is that they may be more familiar to the average investor than the forex or derivatives markets. ETFs also carry stricter margin requirements, so they may appeal to more risk-averse investors. (Check out Profit From Forex With Currency ETFs and Currency ETFs Simplify Forex Trades.)

An example of a popular group of exchange-traded currency product is distributed by Guggenheim Fund Distributors, LLC and known as CurrencyShares Trusts. In case you aren’t familiar, the CurrencyShares Trusts are used by retail or institutional investors as simple, cost-effective ways of holding positions in currencies such as the Australian Dollar, British Pound Sterling, Canadian Dollar, Chinese Renminbi, Euro, Japanese Yen, Singapore Dollar, Swedish Krona and Swiss Franc.

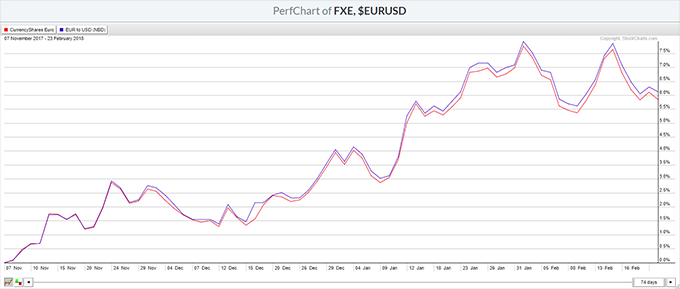

Taking a look at the chart below, you can see the price movements of both the CurrencyShares Euro Trust (FXE) and the EUR/USD Currency pair. For those looking for a tracking asset that can be bought or sold like any other stock without the need for opening a forex or futures account, you can see why these types of products are so popular. (For further reading, see: ETF Tracking Errors: Protect Your Returns)

Indirect Currency Exposure

Forex investors should know that purchasing foreign securities exposes them to the risk of potential currency movements. Investors with no intention of directly trading foreign currencies, however, can benefit from a better understanding of the links between international currencies – because these currency movements can ultimately affect the value of other financial assets. (For more on this topic, check out: Understand Indirect Effects of Exchange Rates)

-

18th Mar 2018, 04:06 PM #4

In forex trading, four major currency pairs are the most popular:

- EUR/USD: The euro and the U.S. dollar

- USD/JPY: The U.S. dollar and the Japanese yen

- GBP/USD: The British pound sterling and the U.S. dollar

- USD/CHF: The U.S. dollar and the Swiss franc

These pairs are discussed in the subsequent chapters of this tutorial, along with the role of each currency in the economy of its country (and the world) and the factors affecting the currency's movement. (Learn more about how pairs are traded in Finding Profit In Pairs.) In brief:

USD/EUR

With all other things being equal, a faster-growing U.S. economy strengthens the dollar against the euro, and a faster-growing European Union economy strengthens the euro against the dollar.

USD/JPY

The USD/JPY features low bid-ask spreads and excellent liquidity. As such, it is an excellent starting place for newcomers to the currency market as well as a popular pair for more experienced traders.

USD/GBP

The GBP/USD is one of the most liquid in the currency market. Bid-ask spreads are tight, and arbitrage opportunities are unlikely to exist. However, the liquidity of the pair combined with the availability of trading instruments makes the GBP/USD an excellent choice for all types of currency traders.

USD/CHF

Although it is somewhat less liquid than the euro and the pound, the Swiss franc is still an easy currency to trade.

-

18th Mar 2018, 04:06 PM #5

The United States and the European Union are two of the largest economic entities in the world. The U.S. dollar is the world's most heavily traded and most widely held currency and was on one side of 87.6% of all trades as of April 2016. The currency of the European Union, known as the euro, is the world's second most popular currency. In 2016, the Euro was on one side of 31.3% of the trades. Naturally, because EUR/USD is made up of the two most popular currencies in the world, it is the most actively traded currency pair in the forex market.

The United States Economy

According to the World Bank, as of 2016, The United States was the largest national economy in the world, with a gross domestic product (GDP) of nearly $19 trillion. The U.S. economy is largely service-based, although according to the Bureau of Economic Analysis, manufacturing still makes up approximately 12% of GDP. When economic activity in the United States is strong, the dollar generally strengthens; when economic activity slows, the dollar usually weakens. Because the United States is also considered a safe haven, the dollar tends to rise during times of global financial or political turmoil. U.S. policymakers have historically favored a strong dollar, and the U.S. Treasury sometimes intervenes in the currency markets if the dollar is perceived as too weak. (Also, see: The Fundamentals Of Forex Fundamentals and The 5 Industries Driving the U.S Economy)

The Unique Role of the U.S. Dollar

The U.S. dollar plays a unique role in the world of international finance. As the world's reserve currency, the U.S. dollar is used to settle most international transactions. When global central banks hold foreign currency reserves, a large portion of those reserves is often held in U.S. dollars. In addition, many smaller countries choose either to peg their currency's value to that of the U.S. dollar or forgo having their own currency, choosing to use the U.S. dollar instead. The price of gold (and other commodities) is generally set in U.S. dollars, too. Not only this, but the Organization of Petroleum Exporting Countries (OPEC) transacts in U.S. dollars. This means that when a nation buys or sells oil, it buys or sells the U.S. dollar at the same time. All of these factors contribute to the dollar's status as the world's most important currency.

Not surprisingly, the U.S. dollar is the most heavily traded currency. Most foreign currencies trade against the U.S. dollar more often than in a pair with any other currency. For this reason, it is important for investors interested in the currency markets to have a firm grasp of the fundamentals of the United States economy and a solid understanding of the direction in which the U.S. dollar is going. (To learn how to profit from a falling dollar, see Taking Advantage Of A Weak U.S. Dollar.)

The European Union Economy

As of 2016, the European Union represented one of the world's largest economic region with a GDP of $11.9 trillion. Like the United States, the economy of Europe is heavily focused on services, although manufacturing represents a greater percentage of GDP than it does in the United States. When economic activity in the European Union is strong, the euro generally strengthens; when economic activity slows, the euro usually weakens. The euro is used by nearly 340 million people every day. (For related reading, see: 5 Economic Reports That Affect The Euro)

Why the Euro Is Unique

While the U.S. dollar is the currency of a single country, the euro is the single currency of 16 European countries within the European Union, collectively known as the "eurozone" or the European and Economic Monetary Union (EMU). Disagreements sometimes arise among European governments about the future course of the European Union or monetary policy. When these political or economic disagreements arise, the euro typically weakens. (To learn more about why the euro is so important, see Top 8 Most Tradable Currencies.)

Which Countries use the Euro?

The euro is the official currency of 19 out of 28 members of the European Union. These countries are collectively referred to by many as the euro area. The countries that use the euro as the official currency include:

- Austria

- Latvia

- Belgium

- Lithuania

- Cyprus

- Luxembourg

- Estonia

- Malta

- Finland

- the Netherlands

- France

- Portugal

- Germany

- Slovakia

- Greece

- Slovenia

- Ireland

- Spain

- Italy

Factors Influencing the Direction of the EUR/USD

The primary factor that influences the direction of the EUR/USD pair is the relative strength of the two economies. With all other things being equal, a faster-growing U.S. economy strengthens the dollar against the euro, and a faster-growing European Union economy strengthens the euro against the dollar. One key sign of the relative strength of the two economies is the level of interest rates. When U.S. interest rates are higher than those of key European economies, the dollar generally strengthens. When eurozone interest rates are higher, the dollar usually weakens.

Another factor that can have a strong influence on the EUR/USD relationship is political instability among the members of the European Union. The euro currency is unique in that it is a common currency for 19 European nations. As the countries within the eurozone learn to work with each other, differences sometimes arise. For example, results from the UK Referendum in 2016 to leave the European Economic Union and major elections in countries such as Germany, France, Greece, Italy, and Spain all have an impact on the direction of currencies. Other major events such as Switzerland’s decoupling from the euro peg also causes major changes to exchange rates. If these differences appear serious or potentially threatening to the future stability of the eurozone, the dollar is likely to strengthen against the euro. (For more, see: Healthiest And Safest European Economies)

Trading the EUR/USD

Because the EUR/USD represents currencies from the world's two largest currencies from the world's two of the largest economic and trading blocs, multinational corporations typically conduct business in both the United States and Europe. These corporations have an almost constant need to hedge their exposure to the risk of currency movement. Some firms, such as international financial institutions, have offices in both the United States and Europe. These firms are also constantly involved in trading the EUR/USD. In 2016, the USD/EUR pair represented 23% of daily turnover. (For more, see: What is hedging as it relates to forex trading?)

Because the EUR/USD is such a popular currency pair, arbitrage opportunities are not often available. However, investors still enjoy trading the pair. As the world's most liquid currency pair, the EUR/USD offers very low bid-ask spreads and constant liquidity for traders wanting to buy or sell. These two features are important to speculators and help contribute to the pair's popularity. Furthermore, the large number of market participants and the availability of economic and financial data allow traders to constantly formulate and reassess their positions and opinions. This constant activity provides for relatively high levels of volatility, which can lead to opportunities for profit.

The combination of liquidity and volatility makes the euro/U.S. dollar pair an excellent place to begin trading for newcomers to the currency market. However, it is always necessary to understand the role of risk management when trading currencies or any other kind of instruments. (For more information, see Forex: Money Management Matters.)

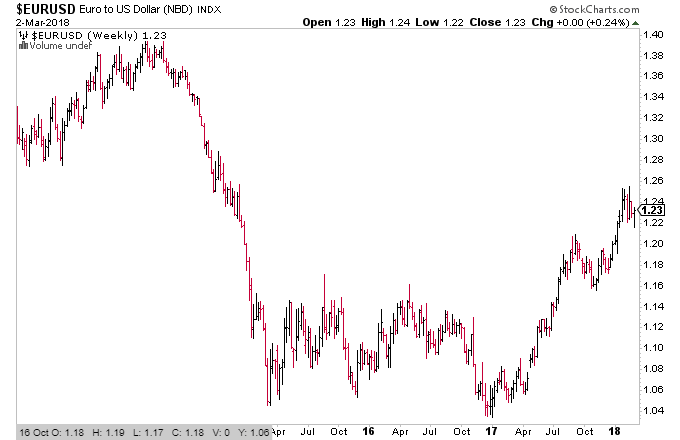

From a technical analysis perspective, by taking a look at the five-year weekly chart of the EUR/USD shown below, you can see that the Euro weakened relative to the U.S. dollar for much of 2014. The period of consolidation between 2015 and 2017 provided a technical base for the pair and was the zone that was needed for traders to have the confidence to push the rate higher again. (For more on this topic, see: Currency Charts To Watch)

-

18th Mar 2018, 04:07 PM #6

According to the World Bank, the Japanese economy is the world's third-largest national economy. Japan is a significant exporter throughout the world. Because of Japan's large amount of trade with the United States, Asia, Europe and other countries, multinational corporations have a regular need to convert local currency into yen and vice versa. Consistently low interest rates has led to a storied history with the yen being a popular currency for the carry trade as well. For these reasons, the USD/JPY is heavily traded in international currency markets. Investors interested in currency trading should closely examine the Japanese economy and the USD/JPY to determine if this is a pair they want to follow.

The Japanese Economy

A small country with little in the way of natural resources, Japan has relied on a strong work ethic, innovative manufacturing techniques, a mastery of new technologies, a high national savings rate, and a close partnership between the government and business sectors to overcome its natural disadvantages. Although the country and its economy were severely damaged during the World War II, the Japanese economy has since grown to become larger than that of every country in the world except the United States.

However, following more than 40 years of nearly unprecedented economic growth, the early 1990s saw an end to the Japanese bull markets in domestic equities and real estate. The bursting of these bubbles led to a sharp economic slowdown and a deflationary spiral. The Japanese banking system was saddled with trillions of yen in bad loans and subsequently cut back its financing activities. Japanese consumer spending also slowed as the country entered a prolonged economic downturn. For nearly two decades, the Japanese government has struggled to reinvigorate the economy and return growth to its previously robust rates. Although these efforts, along with the aggressive use of monetary policy, have not yet been completely successful, Japan has become an economic powerhouse and an important source of global economic activity. (For background reading, see The Lost Decade: Lessons From Japan's Real Estate Crisis and Crashes: The Asian Crisis.)

The Japanese Yen

The Japanese yen is the most heavily traded currency in Asia and the third most actively traded currency in the world. In 2016, the Yen was on one side of approximately 21.6% of daily transactions. At one point during the 1980s, there was conjecture that the yen would join the U.S. dollar as one of the world's reserve currencies. Japan's extended economic decline has ended this supposition, at least temporarily, but the yen remains an extremely important currency in the global financial markets. (Find out how yen carry trades contributed to the credit crisis in The Credit Crisis And The Carry Trade.)

One consequence of Japan's extended period of slow economic growth is that the Japanese central bank has been forced to keep its interest rates very low to spur economic growth. These low interest rates have made the Japanese yen extremely popular in the carry trade. Historically, with carry trades, investors and speculators sell the yen and use the proceeds to purchase higher yielding currencies. This regular selling of the yen has kept its level lower than it otherwise might have been. In recent years, the Bank of Japan has aggressively used interest rates to spur economic growth and have even pushed their central bank rates of minus 0.10%.

Trading the U.S. Dollar/Japanese Yen

The USD/JPY features low bid-ask spreads and excellent liquidity. As such, it is an excellent starting place for newcomers to the currency market as well as a popular pair for more experienced traders. One of the attractions of currencies is that the market is open 24 hours a day, five-and-a-half days a week. U.S.-based investors who enjoy trading at night might consider focusing on the U.S. dollar/yen because the yen is heavily traded during Asian business hours. (For more insight, see In the forex market, how is the closing price of a currency pair determined?)

As previously discussed, selling the yen as part of the carry trade has often been a popular strategy. The popularity of the yen carry trade usually depends on the state of the global financial markets. Interest rates set by central banks around the globe have all moved near zero and in the case of Japan have moved into the negative. While the Yen has traditionally been the funding currency in the carry trade, given the negative rate, many traders have turned toward speculation and betting on short-term shifts in risk tolerance as their preferred trading strategy. Depending on future policy changes, only time will tell when and how traders will choose to return to the yen as the funding currency in the carry trade, which has been the amin driver of the trend over much of the past decade.

Another factor to be aware of when trading the yen is Japan's dependence upon imports and exports. Because Japan is largely dependent on imported oil and other natural resources, rising commodity prices can hurt the Japanese economy and cause the yen to weaken. Slower economic growth among its major trading partners can also cause Japan's export-dependent economy and the yen to weaken. Japan's export dependency can also prompt central bank intervention when the yen begins to strengthen. Although experts debate the effectiveness of central bank interventions, it is important to at least consider what impact they might have. The Bank of Japan has a reputation for intervening in the currency market when movements in the yen appear likely to threaten Japanese exports or economic growth. Investors should be aware of this so that they are not caught by surprise if intervention by the Bank of Japan causes a reversal in the trend of the yen. (For related reading, check out Using Currency Correlations To Your Advantage.)

As the most liquid currency in Asia, the Japanese yen can also be a proxy (substitute) for Asian economic growth. When economic or financial volatility strikes Asia, investors may react by buying or selling the Japanese yen as a proxy for that of other Asian nations whose currencies are more difficult to trade.

Finally, it is important for traders to remember that Japan has endured an extremely long period of subpar economic growth and correspondingly low interest rates. Traders should pay careful attention to the BOJ's use of monetary policy as a meas of driving economic growth. Commentary around rates and possible changes are all major drivers of yen-related pairs. (For related reading, see: The Fundamentals Of Abenomics)

-

18th Mar 2018, 04:07 PM #7

Although it is small in terms of land mass, the economy of the United Kingdom (U.K.) is prosperous. The British (U.K.) pound sterling (or pound) plays an important role in the international financial markets; therefore, investors may want to consider trading it in a pair against the U.S. dollar.

The Economy Of The United Kingdom

For more than a century, the United Kingdom was the most powerful nation in the world. The U.K.'s economy was the world's largest, and the small island nation dominated international trade. During this time, the British pound served as the world's reserve currency. Following the World War I and II, the United Kingdom entered into a period of relative decline as the United States ascended to the position of the world's dominant economic power. The U.K.'s growth also stagnated as heavy government regulation and rigid labor markets impeded economic activity.

However, the U.K. remained reasonably prosperous, and since the 1980s, the country has regained much of its previously lost economic vitality. This rise has coincided with the U.K.'s enhanced reputation as a center for global finance. As U.K. and foreign bankers have flocked to London to seek their fortunes, the financial sector has become a more important part of the U.K.'s overall economy. In fact, financial services make up 7.2% of the U.K.'s total economic output. London accounted for 51% of the financial and insurance sector total Gross Value Added in 2015.Therefore, the direction of the financial markets and the strength of the financial sector play a large role in determining the health of the U.K. economy. (For more on this topic, see: How the UK Makes Money)

The British (U.K.) Pound Sterling

On June 23, 2016, people in the U.K. went to the polls in what is known as the United Kingdom European Union membership referendum, or Brexit referendum. The result was that a majority of voters voted in favor of leaving the EU. While the legal details of withdrawl take years to complete, the process is underway and is expected to be complete by March 30, 2019. Regardless of the withdrawal from the EU, the country remains outside the eurozone (the European Monetary Union) and maintains its own currency, the British pound sterling. (For further reading, see: How Brexit Can Affect the European Economy)

Before the U.S. dollar became the world's reserve currency, the British pound served that role for more than a century. The pound remains an important currency and a popular trading vehicle for traders of all types. The U.S. dollar and the pound are actively traded between each other, and the pair has earned a special nickname among traders, who call it "the cable" in reference to the time when bid and ask quotes were transferred between New York and London via underwater cables across the Atlantic. (For more on trading the GBP, see Top 8 Most Tradable Currencies.)

Trading the British Pound/U.S. Dollar

The GBP/USD is one of the most liquid in the currency market. Bid-ask spreads are tight, and arbitrage opportunities are unlikely to exist. However, the liquidity of the pair combined with the availability of trading instruments makes the GBP/USD an excellent choice for all types of currency traders.

As with the euro/U.S. dollar, the most important factor in determining the relationship between the U.S. dollar and the British pound is the relative strength of the countries' respective economies. When U.S. economic performance is stronger than the U.K.'s, the dollar usually strengthens against the pound. When the U.K.'s economy outperforms that of the U.S., the dollar generally weakens against the pound. This relative strength is often reflected in domestic interest rates, so traders should look carefully at the relationship between U.S. and U.K. interest rates. Because both the U.S. and the U.K. boast very large financial hubs, the performance of the countries' financial sectors and financial markets can also be important in explaining relative currency movements.

Taking a look at the three-year weekly chart of the British Pound to U.S. Dollar (GBP/USD), you can see that the pounded weakened relative to the U.S. dollar for much of 2015 and 2016, but was able to reverse course over 2017 to 2018. The defined channel pattern that has formed on the chart will likely act as strong guides for active traders when determining where to place their buy and stop-loss orders. (For more on this topic, check out: Channeling: Charting A Path To Success)

-

18th Mar 2018, 04:07 PM #8

Switzerland is known as a stable, safe and prosperous nation. Surrounded by the Alps and with a reputation for neutrality, Switzerland has long appeared to be almost a world unto itself. Economically, this reputation has been enhanced by the famous secrecy of the Swiss banking system. Although Swiss banking rules have loosened somewhat in the past 10 years, Switzerland remains an international hub of private banking, insurance and investment management. In addition, Swiss citizens enjoy one of the highest standards of living in the world. (To read more about Swiss banking, see What are the Gnomes of Zurich? and How do I open a Swiss bank account and what makes them so special?)

Although the country remains outside the European Union to maintain its neutrality, Switzerland does enjoy extensive trade with its European neighbors, the United States, and other countries around the world. Switzerland is also home to large multinational corporations such as the banking giants, UBS (NYSE:UBS) and Credit Suisse (NYSE:CS), and the consumer products company, Nestle.

The Swiss Franc

Switzerland's currency plays an important role in the international capital markets. Because of Switzerland's historic political neutrality and reputation for stable and discreet banking, the Swiss franc is commonly viewed as a safe haven in international capital markets. As such, many investors prefer to hold a portion of their assets in the Swiss franc. Many other traders flee to the safety of the Swiss franc during times of international turmoil. Therefore, when volatility appears in the financial markets, investors often bid up the Swiss franc at the expense of other currencies.

Trading the U.S. Dollar/Swiss Franc

Although it is somewhat less liquid than the euro and the pound, the Swiss franc is still an easy currency to trade. In April 2016, the Swiss franc was on one side of 4.8% of all trades, which is substantial when you consider the overall size of the forex market.The factor most likely to cause large movements in the value of the Swiss franc is international political and economic instability. When either political or economic turmoil increases, investors flee to the perceived safety of the Swiss franc. When volatility decreases, the Swiss franc typically sees less interest from traders and investors.

While the Swiss franc often does rise against most other currencies during volatile periods, forecasting the relative performance of the Swiss franc versus the U.S. dollar can be difficult, because the U.S. dollar is also viewed as a safe haven during times of turmoil. Therefore, it is not always easy to determine whether the Swiss franc or the U.S. dollar will be the preferred source of safety during an international crisis. Since each crisis is unique, a determination must be made as to whether the Swiss franc or the U.S. dollar is the preferred option for investors seeking safety.

During less volatile times, traders should note that the Swiss franc has a very high correlation to the euro. When the value of the euro increases, so too does that of the franc. If investors witness a rise or decline in the euro without a corresponding move in the franc, they may want to consider initiating a trade based on the belief that the franc will eventually resume its historical correlation with the euro. (To learn about another popular pair that includes the "Swissie", see Making Sense Of The Euro/Swiss Franc Relationship.)

Although this type of relative value trade is extremely popular in the financial markets (and often profitable), traders should bear in mind that there is no guarantee that markets will revert to their historical mean. For example, on January 15, 2015, the Swiss National Bank (DNB) shocked the investment world when it suddenly announced it would no longer peg the Swiss franc to the euro. The Swiss franc skyrocketed relative to the euro, which you can see in the chart below. This event stands as one of the best examples in recent times as what happens if you get caught on the wrong side of the trade. In this case, too much leverage or poor risk management could have been enough to cause a trader’s capital to get wiped out in a matter of minutes. (For more, see: Why Switzerland Scrapped the Euro)

-

18th Mar 2018, 04:08 PM #9

The commodity currencies are currencies from countries that possess large quantities of commodities or other natural resources. Natural resources often constitute the majority of the countries' exports, and the strength of the economy can be highly dependent on the prices of these natural resources. Countries that are rich in natural resources include Russia, Saudi Arabia, Nigeria and Venezuela. However, the currencies of many natural-resource-rich countries are either regulated by the government or otherwise rarely traded in international markets. Therefore, commodity currency trading typically focuses on three countries that are rich in natural resources and also have liquid, freely floating currencies: Canada, Australia and New Zealand. (For background reading, see Commodity Prices And Currency Movements.)

The Canadian Economy

Canada features a dynamic, modern economy. According to the World Bank, based on gross domestic product (GDP) per capita in 2016, Canada boasted the tenth-highest standard of living in the world. The country is blessed with large quantities of commodities including natural gas, timber and oil. This makes Canada's economy very sensitive to commodities prices. Canada also benefits from its geographic location just to the north of the United States, the world's largest economy. Because of this proximity, the vast majority of Canada's exports go directly to the United States. Therefore, the Canadian economy is also closely linked to the state of the U.S. economy, because weaker growth in the U.S. can result in decreased exports for Canada. (To learn about another Canadian investment, see An Introduction To Canadian Income Trusts and Canada's Commodity Currency: Oil And The Loonie.)

The Australian Economy

Australia is one of the world's most natural-resource-rich countries and has large holdings of gold, iron, copper, coal and aluminum. Australia also has very large farms that produce goods such as wheat, beef and wool. In addition to natural resources and farm products, Australia also boasts a modern industrialized economy and a large service sector. Despite these economic advantages, Australia suffers somewhat because it is geographically isolated and has a relatively small population. In light of this, Australia finds it necessary to import large quantities of goods not produced domestically. These imports can result in large trade deficits that pressure the Australian dollar. (For related reading, see A Forex Trader's View Of The Aussie/Gold Relationship.)

The New Zealand Economy

New Zealand is a small island nation blessed with many natural resources and a large agricultural sector. These resources result in the New Zealand economy's heavy exposure to international commodity prices. The country is also extremely open to international trade and foreign investment and is a popular destination for tourism. (For related reading, see: What is the name of the currency in New Zealand?)

Factors Influencing Commodity Currency Movements

The primary determinant of the movement of the commodity currencies is the price of key underlying commodities such as gold or oil etc. As a general rule, investors would expect that when the price of commodities is high, the currencies of the commodity producers also strengthen. When commodity prices are weak, the currencies weaken. During times of strengthening commodity prices, the economies in commodity-producing nations usually grow rapidly, which can lead to high domestic interest rates. High interest rates can make these countries popular with the carry trade, in which investors sell low-yielding currencies and reinvest the proceeds in high-yielding currencies. These carry trades can drive the prices of commodity-producing currencies higher than they otherwise might have been. However, when financial conditions change, the carry trade can be reversed very quickly, which can result in capital flight from the destination country and a swift decline in the currency value. (For more, see: What Factors Move a Currency?)

Trading the Commodity Currencies

The currencies of Canada, Australia and New Zealand are all actively traded but are less liquid than those of the United Kingdom, Japan or the eurozone. Additionally, comparing the economies of commodity-producing nations to that of the United States can be difficult, because the comparison is not "apples to apples". In general, traders should focus on the trend in commodity prices to determine whether the currencies of Canada, Australia and New Zealand are likely to rise or fall in the near future. In the case of Australia and New Zealand, relative interest rates are also important because they are popular destinations for the carry trade. In recent years, interest rates in Australia or New Zealand have been much higher than those in other countries such as Japan, investors have tended to employ the carry trade by selling the yen and purchasing the Australian or New Zealand dollar. These trades help drive up the value of the Australian and New Zealand currencies. When interest-rate differentials reverse or market volatility prompts traders to scale back their positions, the Australian and New Zealand currencies can swiftly decline. (For further reading, check out: How To Trade Currency and Commodity Correlations)

Be aware that investing in commodities or commodity-producing companies may produce direct exposure to commodity prices. Although the commodity currencies typically move in tandem with commodity prices, the currencies are also influenced by additional, unrelated factors. These factors can prevent commodity currencies from being a "pure play" on commodity prices. Therefore, individuals interested in commodity exposure should carefully consider whether they want to trade the commodity currencies or would prefer to invest directly in the commodities themselves. (For further reading, see: How are foreign exchange rates affected by commodity price fluctuations?)

-

18th Mar 2018, 04:08 PM #10

While the majority of currency trading involves the U.S. dollar, major international currencies also trade among themselves. A currency trading pair that does not involve the U.S. dollar is known as a currency cross rate. For instance, a U.K. company with sales in Germany might wish to convert the euros it has received back into British pounds. The company does not need to convert euros into dollars before converting dollars into pounds. Instead, the U.K. company can use the EUR/GBP cross rate to convert the euros directly into pounds.

As discussed in the introduction to this tutorial, by far the two most heavily traded currencies in the world are the U.S. dollar and the euro. Because currency cross rates, by definition, do not include the U.S. dollar, the most heavily traded cross-rate pairs do involve the second most commonly used currency, the euro. In April 2016, the most popular cross-rate pair was the EUR/GBP, mentioned above, represented 2% of the total trades. Cross-rate pairs are also common among the other major international currencies, including the yen and the Swiss franc. Other, less liquid currencies often do not trade actively except against the U.S. dollar. For investors interested in transacting between these less liquid currencies, two trades must be made – first a conversion from the foreign currency into the U.S. dollar, followed by a second conversion from the U.S. dollar into the desired functional currency. (For background reading, see Make The Currency Cross Your Boss and The Foreign Exchange Interbank Market.)

Unique Characteristics of Cross Rates

There are several unique characteristics of currency cross rates. For one thing, an investor interested in cross rates does not need to be as concerned with the fundamentals of the U.S. economy as an investor trading more traditional pairs.

A second unique characteristic of cross rates is that they are usually somewhat less liquid (and less actively traded) than traditional pairs, bringing both benefits and drawbacks for investors. Because cross currency pairs are less heavily followed, investors may have greater opportunity to discover unique insights into market movements. It may also be more feasible for investors to find arbitrage opportunities if they are employing less commonly traded currencies. Finally, the relative lack of liquidity may result in greater volatility during turbulent periods. Greater volatility provides investors with the opportunity to generate larger profits (or the possibility of larger losses). The negative consequence of trading cross rates is that lower liquidity can result in wider bid-ask spreads; and, in extreme situations, traders may even have difficulty in entering or exiting their positions. (For more, see: The Fundamentals Of Forex Fundamentals)

Factors Influencing Cross Rates

Because most of the actively traded cross rates involve large international currencies such as the euro or the yen, the factors that influence these relationships are similar to those that influence a relationship between the U.S. dollar and other large international currencies. In particular, relative differentials in the countries' economic strength, inflation rates and interest rates typically cause the majority of market movements among these currencies.

Perhaps the most important factor in cross-rate movements is not what affects them, but what does not. Cross rates are not directly influenced by the direction of the U.S. dollar. When trading traditional pairs such as the EUR/USD, the USD/JPY, or the GBP/USD, it can be difficult for traders to differentiate their market views. That is because all of these relationships ultimately depend upon either the strength or the weakness of the U.S. dollar. There are exceptions to this; but, generally speaking, during a strong uptrend in the U.S. dollar, it is likely the dollar will advance against most of the other major currencies. When the dollar is suffering systemic weakness, it is likely that it will decline against most of the currencies. This means that regardless of which pair traders focus on, the most important determinant of their success will be whether they are bullish or bearish on the U.S. dollar.

When trading cross rates, though, a trader does not need a bearish or bullish view on the U.S. dollar. Instead, the movements in these relationships are determined by the fundamentals and market trends in their respective economies. These relationships provide investors with an excellent opportunity to diversify away from the U.S. dollar in their currency trading.

This does not mean, however, that traders of cross currency pairs can completely ignore the U.S. As the world's most important currency, the U.S. dollar's developments can send ripple effects throughout the currency markets. These effects can even influence pairs that do not directly involve the U.S. dollar. While movements in the U.S. dollar do have some impact on global exchange rates, they are not the primary determinant in a cross-rate relationship.

Trading Cross Rates

When trading one of the major pairs such as the EUR/USD, it is difficult for an investor to discover unique insight into market events. That is because the pair is so heavily traded in the marketplace that countless investors and traders are continually employing significant resources to forecast future market movements. However, by focusing on a slightly less popular cross rate, an investor can find more opportunities for contrarian opinions in the dynamics of the relationship. These opinions may lead to the possibility of higher returns than those found in the more traditional U.S. dollar-based pairs.

The opportunity to generate above-average returns by studying and researching cross currency pairs makes this corner of the currency market a potentially attractive one for investors. The key is to focus on one or two of the cross currency relationships and learn as much as possible about their movements. By doing so, investors may have the ability to profit in this less-closely-watched sector of the marketplace. (For more, see: How can I trade in cross currency pairs if my forex account is denominated in U.S. dollars?)

-

18th Mar 2018, 04:08 PM #11

While the majority of trading takes place among the currencies of the largest industrialized economies, emerging market economies and their currencies are playing an increasingly important role in the international financial markets. In fact, in April 2016, currencies from emerging market economies represented 21.2% of daily trading. Therefore, investors interested in currency trading will want to achieve an understanding of the unique challenges and opportunities facing the emerging market economies so that they can formulate their own perspective as to the feasibility of trading emerging market currencies.

Emerging Market Economies

Emerging markets are developing countries with transitions occurring in economic, political, social and demographic dimensions. The countries listed (as emerging markets) range from Kenya, with a per-capita income of $1,455 in 2016, to Mexico with a per-capita income just above $8,200, according to the World Bank. In emerging market countries, the financial and banking systems are usually still forming (compared to those in more developed economies), and the middle-class population may be small or even nonexistent. These characteristics result in greater financial volatility and larger swings between economic prosperity and economic decline. Additionally, emerging markets often have political systems that are less stable than those of developed nations, resulting in a greater possibility of governmental actions that adversely affect investors. (For background reading, see The New World Of Emerging Market Currencies and What Is An Emerging Market Economy?)

Unique Characteristics of Emerging Market Currencies

Emerging market currencies are unique in several respects. Because emerging market countries are developing economically and/or politically, there are special risks that come with investing in emerging market currencies. Political risk is always a concern for international investors, but emerging markets tend to have an even greater uncertainty in the political arena. Sudden changes in the political regime can result in large unexpected movements in the price of currencies, potentially generating large losses for investors. In extreme examples, some emerging market countries have limited investors' ability to withdraw currency from the country, thereby effectively freezing investing capital. (For more insight, check out Evaluating Country Risk For International Investing.)

Another unique feature of emerging markets is the structure of their currencies. Most of the larger economies, such as the United States, the United Kingdom, Japan and Canada, have independent currencies that are allowed to float relatively freely. In contrast, many emerging market countries do not allow their currencies to float freely. One popular form of governing the currency is "pegging" the domestic currency to a foreign currency. This foreign currency is commonly the U.S. dollar or a "basket" (group) of developed-nation currencies, such as the U.S. dollar, the euro and the yen.

Practicality of Trading Emerging Market Currencies

For many individual investors, trading emerging market currencies may not be practical. Emerging markets often suffer from illiquidity and large bid-ask spreads – conditions that are exacerbated during times of market volatility. This volatility stems from the inherent risk involved – the substantially higher economic, financial and political risk. While higher volatility can produce additional trading opportunities, it also drastically increases the chances of suffering large losses. Therefore, emerging market currency trading is often best left to the most experienced and well-capitalized individual traders.

This does not mean that individual investors who are unable or unwilling to trade these currencies directly cannot be exposed to emerging market currencies. When investors buy or sell an emerging market country's stock, bond, mutual fund, or exchange-traded fund, they are effectively buying or selling that country's currency as well. Therefore, an investor with a large holding in Mexican stocks can benefit from a stronger Mexican peso. On the other hand, a U.S. investor who wants to purchase stocks in Thailand hopes that the U.S. dollar strengthens against the Thai baht before the purchase. In short, the U.S. investor should hope for a strengthening U.S. dollar before buying foreign securities and a strengthening of the foreign currencies (relative to the U.S. dollar) before selling the foreign securities. (For related reading, see: How A Strong U.S. Dollar Can Hurt Emerging Markets)

Although the typical investor's exposure to emerging market currencies (or other foreign currencies) may not seem substantial, international stock or bond exposure via popular exchange-traded funds and other asset classes can be sigificant.This is an important factor to remember and means that even international investors with no intention of directly trading foreign currencies should understand the influence currency movements can have on foreign stock and bond holdings. (For more, see: Top 3 Emerging Market ETFs)

-

18th Mar 2018, 04:09 PM #12

Top basic forex tips

- The currency markets are the largest and most actively traded financial markets in the world with daily trading volume of more than $5.1 trillion (Triennial Central Bank Survey 2016).

- Each transaction in the currency market involves two different trades: the sale of one currency and the purchase of another.

- As the world's reserve currency, the U.S. dollar is the most actively traded currency; pairs involving the dollar make up 87.6% of transactions.

- Most currency trading strategies fall into two broad categories: hedging and speculating.

- To avoid possible loss from fluctuating currencies, companies can hedge, or protect themselves, by trading currency pairs.

Arbitrage trades, carry trades, and other ways to invest in forex

- In arbitrage trades, an investor simultaneously buys and sells the same security (or currency) at slightly different prices, hoping to make a small risk-free profit.

- Another popular category of currency trade is the carry trade, which involves selling the currency of a country with very low interest rates and investing the proceeds in the currency of a country with high interest rates.

- There are several markets available to currency traders, including the forex market, derivatives markets and exchange-traded funds.

- The majority of currency trading takes place in the forex spot market. In the forex spot market, large banks and other financial institutions trade currencies among themselves either for immediate delivery (spot market) or for settlement at a later date (forward market.)

- Derivatives include futures, options and exotic, customizable derivative contracts. While the more exotic derivatives are generally designed for institutional investors, individual investors often use futures and options.

- Individual investors can buy or sell the futures or the options to speculate on the direction of the currency pair.

- ETFs have been popular vehicles for tracking stock or bond indexes for many years, but ETFs that track currency movements are relatively new. A currency ETF can be bought and sold just like any other stock.

The four big forex pairs

- Investors with no intention of directly trading foreign currencies, however, can benefit from a better understanding of the links between international currencies – because these currency movements can ultimately affect the value of other financial assets.

- Four major currency pairs are the most popular: EUR/USD, the euro and the U.S. dollar; USD/JPY, the U.S. dollar and the Japanese yen; GBP/USD, the British pound sterling and the U.S. dollar; and USD/CHF, the U.S. dollar and the Swiss franc.

- Because they are the two most popular currencies in the world, the euro and the U.S. dollar are the most actively traded currency pair.

- Most foreign currencies trade against the U.S. dollar more often than in a pair with any other currency. For this reason, it is important for investors interested in the currency markets to have a firm grasp of the fundamentals of the United States economy and a solid understanding of the direction in which the U.S. dollar is going.

- While the U.S. dollar is the currency of a single country, the euro is the single currency of 19 European countries within the Euro area, collectively known as the Economic Monetary Union (EMU).

- The primary factor that influences the direction of the EUR/USD pair is the relative strength of the two economies.

- Because of Japan's large amount of trade with the United States, Asia, Europe, and other countries, multinational corporations have a regular need to convert local currency into yen and vice versa.

- The Japanese central bank has been kept its interest rates very low and in recent years have moved it into negative territory to spur economic growth following a long period of economic decline. These historically low interest rates have made the Japanese yen extremely popular in the carry trade.

- The USD/JPY pair features low bid-ask spreads and excellent liquidity. As such, it is an excellent starting place for newcomers to the currency market as well as a popular pair for more experienced traders.

- Although the U.K. voters have decided that it is in Great Britan’s best interest to withdraw from the European Union, it is still closely connected to Europe and its currencies will likely remain positively correlated into the future.

- The GBP/USD pair is one of the most liquid in the currency market and represents 9.2% of daily transactions as of April 2016.

- As with the EUR/USD, the most important factor in determining the relationship between the U.S. dollar and the British pound is the relative strength of the countries' respective economies.

- Although the country remains outside the European Union to maintain its neutrality, Switzerland does enjoy extensive trade with its European neighbors, the United States and other countries around the world.

- Because of Switzerland's historic political neutrality and reputation for stable and discreet banking, the Swiss franc is commonly viewed as a safe haven in international capital markets.

- Although it is somewhat less liquid than the euro and the pound, the Swiss franc is still an easy currency to trade.

- The factor most likely to cause large movements in the value of the Swiss franc is international political, internal monetary policy decisions, and economic instability.

Commodity currencies

- The commodity currencies are currencies from countries that possess large quantities of commodities or other natural resources.

- Commodity currency trading typically focuses on three countries that are rich in natural resources and also have liquid, freely floating currencies: Canada, Australia and New Zealand.

- The Canadian economy is also closely linked to the state of the U.S. economy, because weaker growth in the U.S. can result in decreased exports for Canada.

- Australia finds it necessary to import large quantities of goods not produced domestically. These imports can result in large trade deficits that pressure the Australian dollar.

- New Zealand is a small island nation blessed with many natural resources and a large agricultural sector. These resources result in the New Zealand economy's heavy exposure to international commodity prices.

- The primary determinant of the movement of the commodity currencies is the price of commodities.

- The currencies of Canada, Australia, and New Zealand are all actively traded but are less liquid than those of the United Kingdom, Japan or the eurozone.

Currency trading pairs

- A currency trading pair that does not involve the U.S. dollar is known as a currency cross rate.

- Because currency cross rates, by definition, do not include the U.S. dollar, the most heavily traded cross pairs do involve the second most commonly used currency, the euro.

- An investor interested in cross rates does not need to be as concerned with the fundamentals of the U.S. economy as an investor trading more traditional pairs.

- A second unique characteristic of cross rates is that they are usually somewhat less liquid (and less actively traded) than traditional pairs, bringing both benefits and drawbacks for investors.

- Perhaps the most important factor in cross-rate movements is not what affects them, but what does not. Cross rates are not directly influenced by the direction of the U.S. dollar.

- The opportunity to generate above-average returns by studying and researching cross currency pairs makes this corner of the currency market a potentially attractive one for investors.

Emerging market forex

- In emerging market countries, the financial and banking systems are usually still forming (compared to those in more developed economies), and the middle-class population may be small or even nonexistent. These characteristics result in greater financial volatility and larger swings between economic prosperity and economic decline.

- Emerging markets often have political systems that are less stable than those of developed nations, resulting in a greater possibility of governmental actions that adversely affect investors.

- Some emerging market countries do not allow their currencies to float freely.

- Emerging markets often suffer from illiquidity and large bid-ask spreads – conditions that are exacerbated during times of market volatility.

- Individual investors who are unable or unwilling to trade emerging market currencies directly can still be exposed to the risk.

- International investors with no intention of directly trading foreign currencies should understand the influence currency movements can have on foreign stock and bond holdings.

-

12th May 2019, 06:11 PM #13

Popular Forex Currencies

Popular Forex Currencies

guysIm happy to give you my signals for currencies. Each week I will write a swing signal if there was a good signal and daily I will put a signal with 100 pips target 70 pips stop loss. All the signals will be with the chart and reasons . I hope all of signals would be green.Wait me after some hours. Regards,Abanoub

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Similar Threads

-

[GET] Learn to Trade Forex and Stocks: From Beginner to Advanced

By AliKashif7 in forum Udemy 100% FREE for LIMITED TIMEReplies: 2Last Post: 13th May 2019, 02:57 PM -

Mining of crypto-currencies on P2pool

By kryptonite in forum Mining and PoolsReplies: 0Last Post: 13th Jan 2016, 02:42 PM

Reply With Quote

Reply With Quote

Staff Online

Staff Online

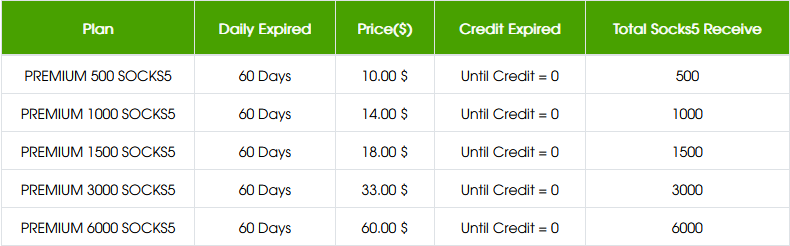

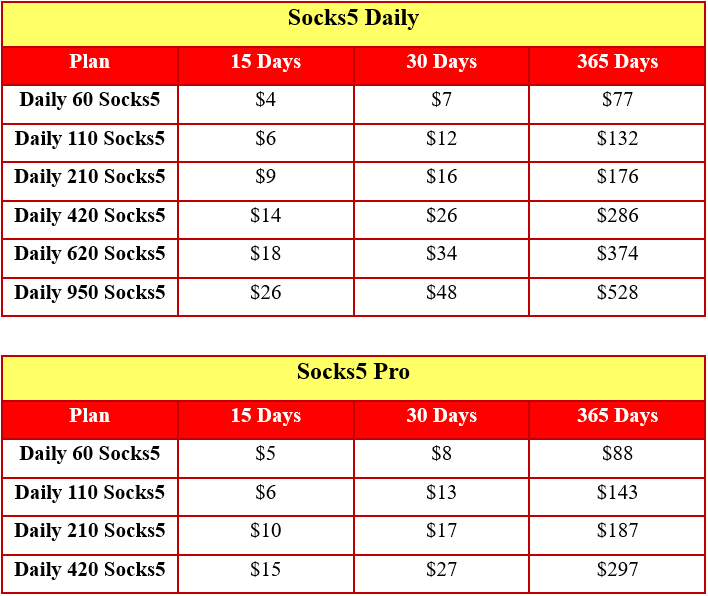

Shopsocks5.com - Service Socks5...

[Free Trial] https://shopsocks5.com/ - Service...